Background

Role: Designer, Researcher, Facilitator

Time Frame: May 2019 - March 2020

Tools: Sketch, InVision, Trello, Miro, Zoom

Project Overview: In May 2019, Wayfair was at a crossroads with a critical piece of our vendor-facing platform - Catalog and Merchandising tools. These applications represent a significant part of the vendor experience, and are at the core of Wayfair’s eCommerce business, empowering our vendors to provide and manage data about the millions of products on Wayfair.com.

I was asked to lead a research project to inform a build vs buy decision. As part of this project, I proposed a timeline and research plan consisting of three main parts: Competitor Research, Qualitative Interview, and Quantitative Analysis. I was assigned a junior research who would help with the execution of the research phase of the project. Based on that research I developed a core problem statement.

Problem Statement: We designed our current catalog tools to focus on getting SKUs on site. Over time, Wayfair merchandising and Supplier catalog management needs have evolved beyond our current tool’s capabilities. As a result, Suppliers frequently experience issues navigating Wayfair’s complex and tangled network of catalog management tools to accomplish even simple tasks. We believe that a flexible and robust platform to manage product data from inception through various endpoints, including addition and other services, will enable Suppliers to scale through deeper integrations with Wayfair.

Research Planning (1)

Research Planing (2)

Discovery Research

Research Objectives

Our research was focused on:

- Identifying vendor needs related to product catalog management

- Evaluating the need among customers for a Product Information Management (PIM) solution

- Understanding value props tied to a PIM solution

Qualitative Research

Over 5 weeks, I and a junior researcher conducted 11 intensive onsite and virtual interviews with our vendors, including US and EU vendors. These vendors varied in size from small mom-and-pop shops to large, multinational corporations with sophisticated supply chains; some of these vendors had PIMs (both custom-built and off-the-shelf) and others did not. In order to efficiently use our time, we split the interviews so that the researcher conducted some in partnership with the product team, and I conducted others independently.

I’d worked with this researcher previously and after talking to their manager, wanted to ensure that they would be prepared for intensive interviews (2-3hrs in length) and the synthesis. They shadowed one of the interviews I did and we reviewed another recorded interview I conducted together in order to help them prepare to conduct their own sessions. These were mainly focused on how to navigate such a broad spectrum of topics and effectively use a very general moderator guide to get specific information.

After all of the interviews were finished, I led two synthesis sessions with Product Management, Business stakeholders, and research/design. To make the broad research as useful as possible, I decided to store each observation in a centralized Trello board with a timestamp from the relevant interview. As we reviewed the observations and notes, we copied these into “theme” lists (ex. Product development is a split process between teams, tools, and sources for info). Is allowed us to recycle the same observation for multiple themes. Moreover, it has allowed other teams to leverage our raw data to conduct their own synthesis with their own lens.

Research Board in Trello

After we had these affinity mapped groups, we worked as a group to refine some of these statements to be more precise. These ultimately became our 12 user needs.

After we agreed on the basic user needs, I led a laddering exercise focused on abstracting up from these observational themes and user needs, to higher level insights. Based on this we arrived at three core insights:

1) Generating, Organizing, and Curating content is a complex and global process for our vendors, who are getting information from multiple sources and throughout the product lifecycle

2) As Wayfair as developed new tools and expanded our schema, vendors have had to develop ad-hoc solutions to manage new data and deal with new needs as they arise. This had led to a patchwork solution that is brittle and inflexible

3) The shift from a brick and mortar business model which generally accounts for the majority of vendor sales, to a click-driven (eCommerce) model has created a sudden need for far more content to market to digital consumers. Vendors are still “catching up” with the demands of this new model

Quantitative Research

Afterwards, the Product Manager and Researcher developed a quantitative survey to measure the business impact of the initiative. While I was not directly involved in the synthesis, I provided guidance and support to the team as they designed the survey. We heard from >1600 vendors and found that the easier catalog management tasks were perceived to be, the larger assortment of products Wayfair got from vendors, and the more revenue they generated.

The lead product manager and I took the synthesized research (qualitative and quantitative) and presented it to senior leadership (Product Directors, VP of Catalog Product) during a recap meeting. We were asked to mock up some potential ways we could approach the problem.

Ideation and Exploration

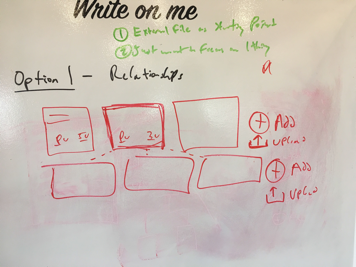

Whiteboard - Capture Relationships

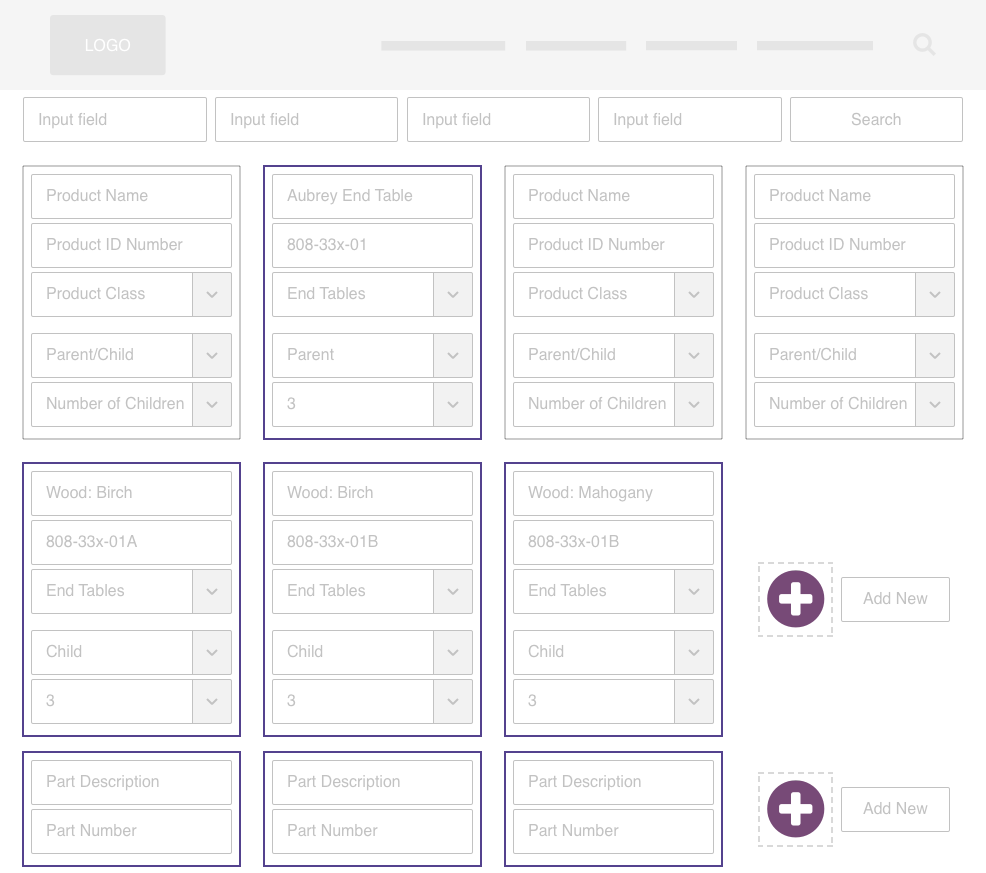

Lofi Wireframe - Relationships

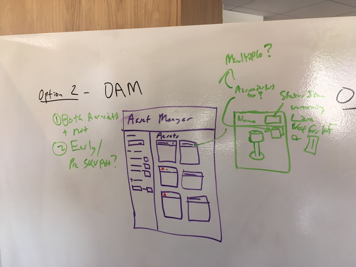

Whiteboard - Centralized Asset Storage

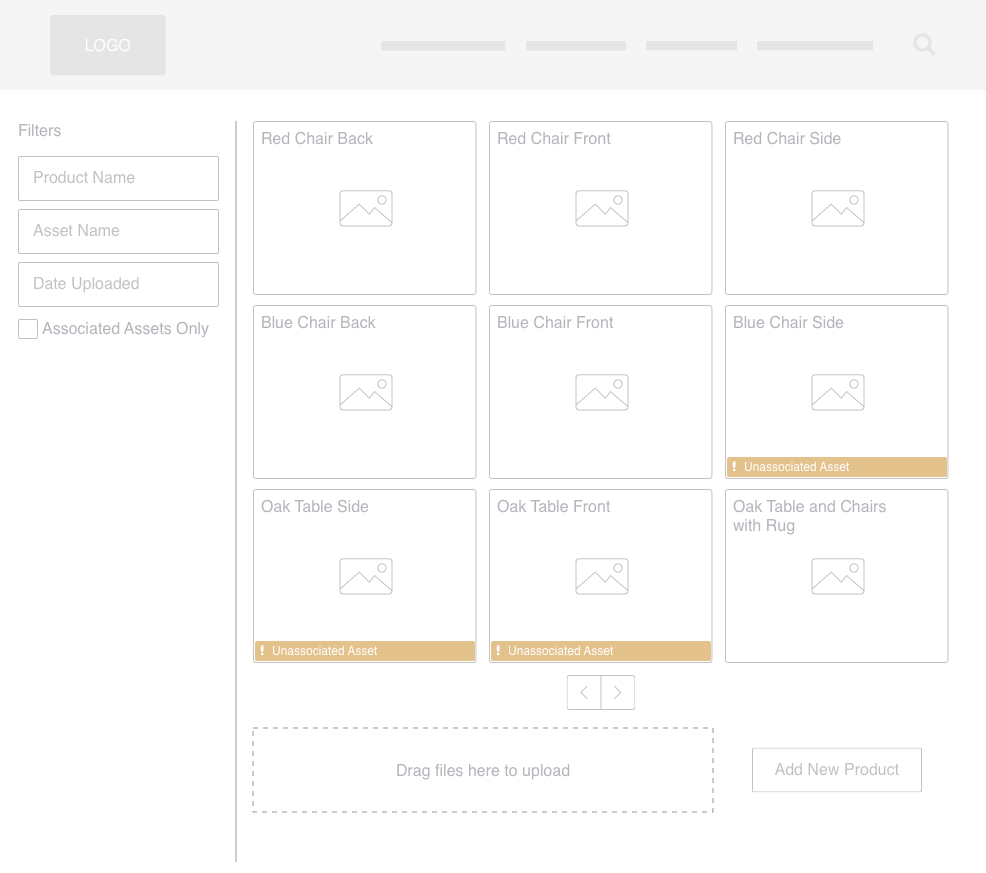

Lofi Wireframe - CAS

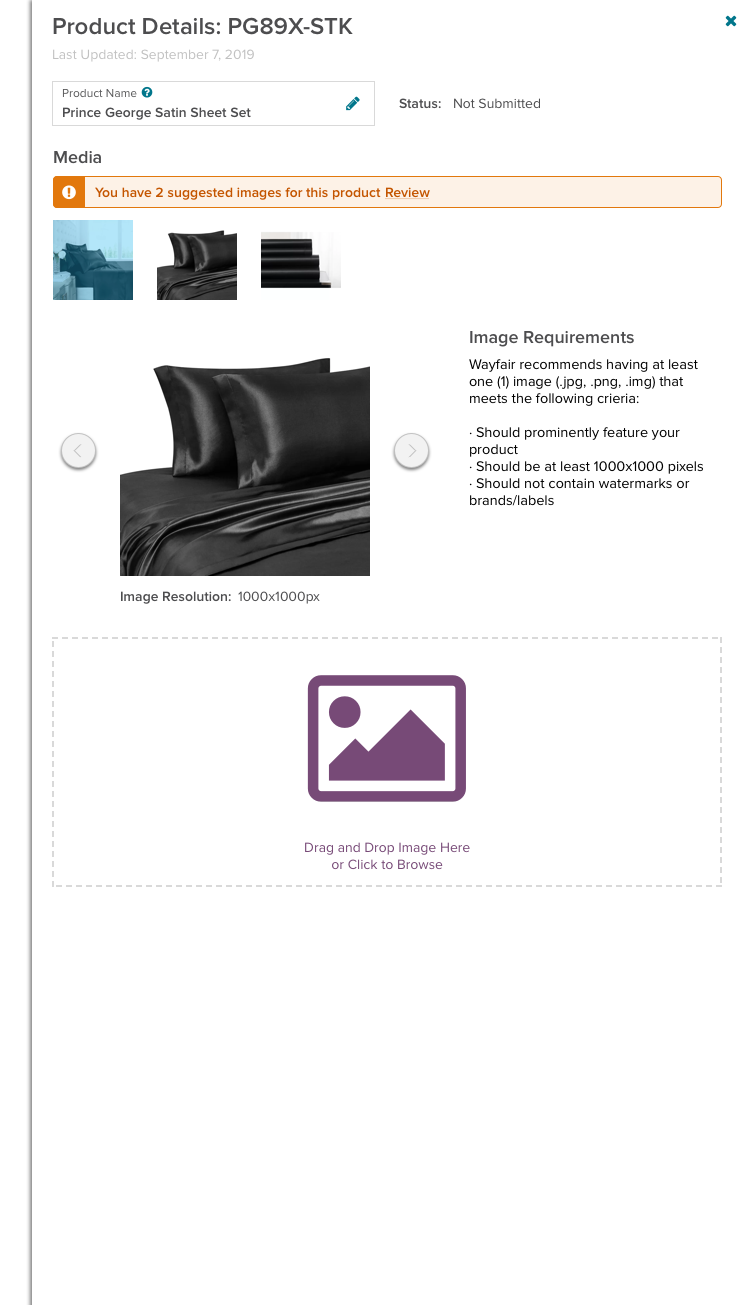

Whiteboard - Imagery Requirements

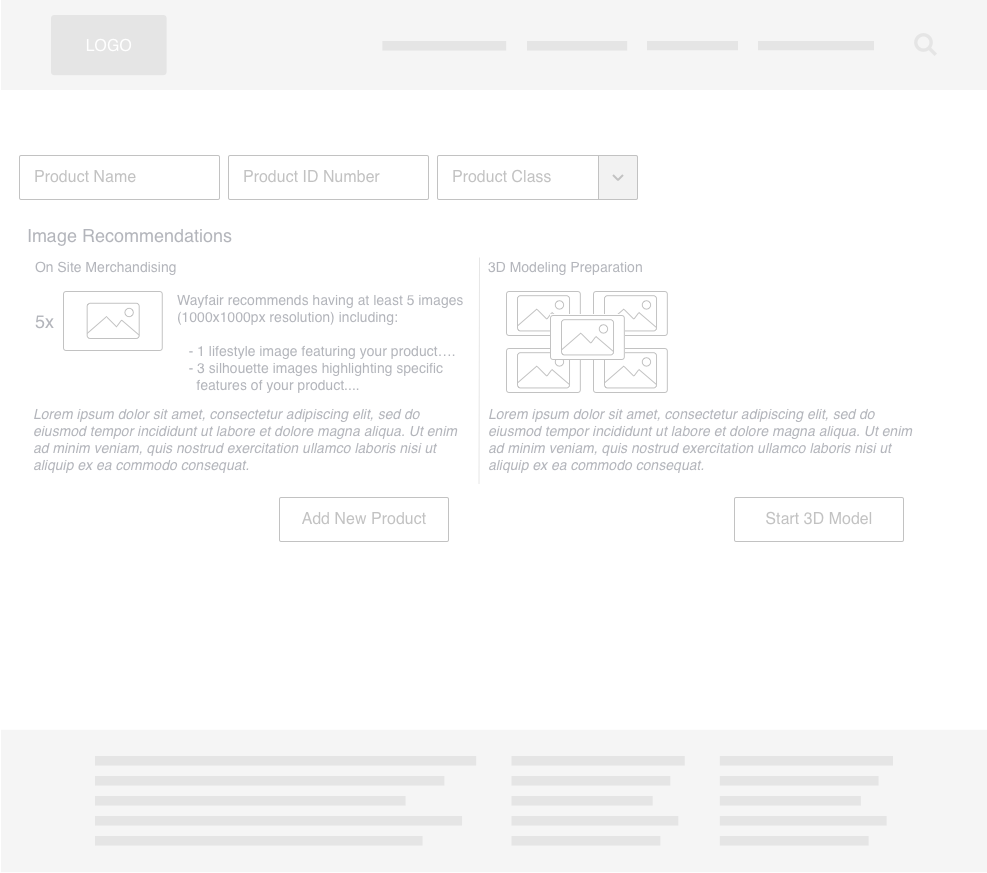

Lofi Wireframe - Imagery Requirements

Whiteboard - Centralized Content Gathering

Lofi Wireframe - CCG

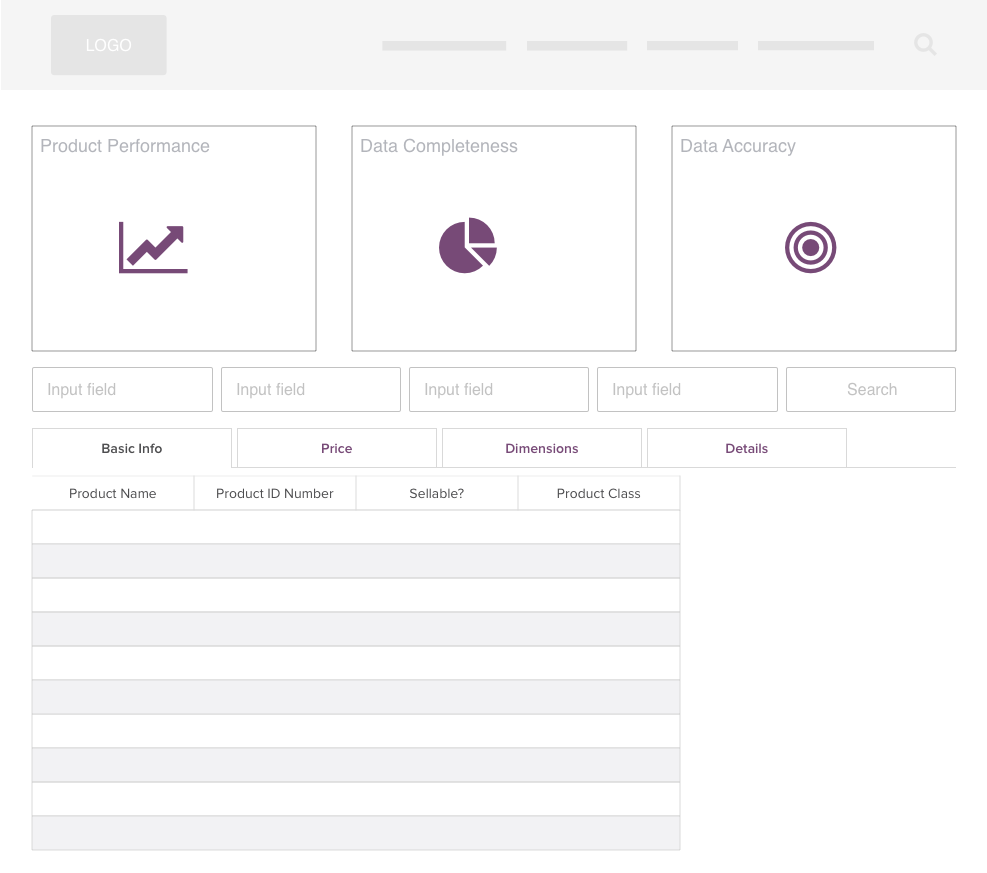

In response to the request from senior leadership to mock up and evaluate potential MVPs, I worked with the product managers and researcher to identify four key hypotheses we believed we could test. In our discussion, I drew whiteboard diagrams and visuals to help guide the team. Afterwards, I converted these diagrams into low fidelity mockups using Sketch. The purpose of these mockups was to drive decision making amongst the larger senior stakeholder team.

Shortly after this, we hired an additional designer and decided that we could manage to design two MVPs for the same project at once. Each MVP team would tackle one of the problems that had been identified. I shifted focus to support one of the product teams in developing one of these MVPs.

Prototyping

To accelerate our learning process, the Product Manager and I agreed to leverage available engineering resources build a data-driven working prototype that we could make available to a small select group of test users. This was because we were more interested in understanding how this MVP could solve our users’ problems than in understanding what problems we should solve. The product manager and I groomed a list of potential vendors that could be invited to be development partners; we wanted to find a group of three that were willing to participate and were a good representational cross-section of our user base.

Over the next 6 months, I worked closely alongside our developers to mock up screens, review what they built, and test this prototype with our three selected development partners. The project is still ongoing and is planned to be released to a broader user base sometime in 2020.

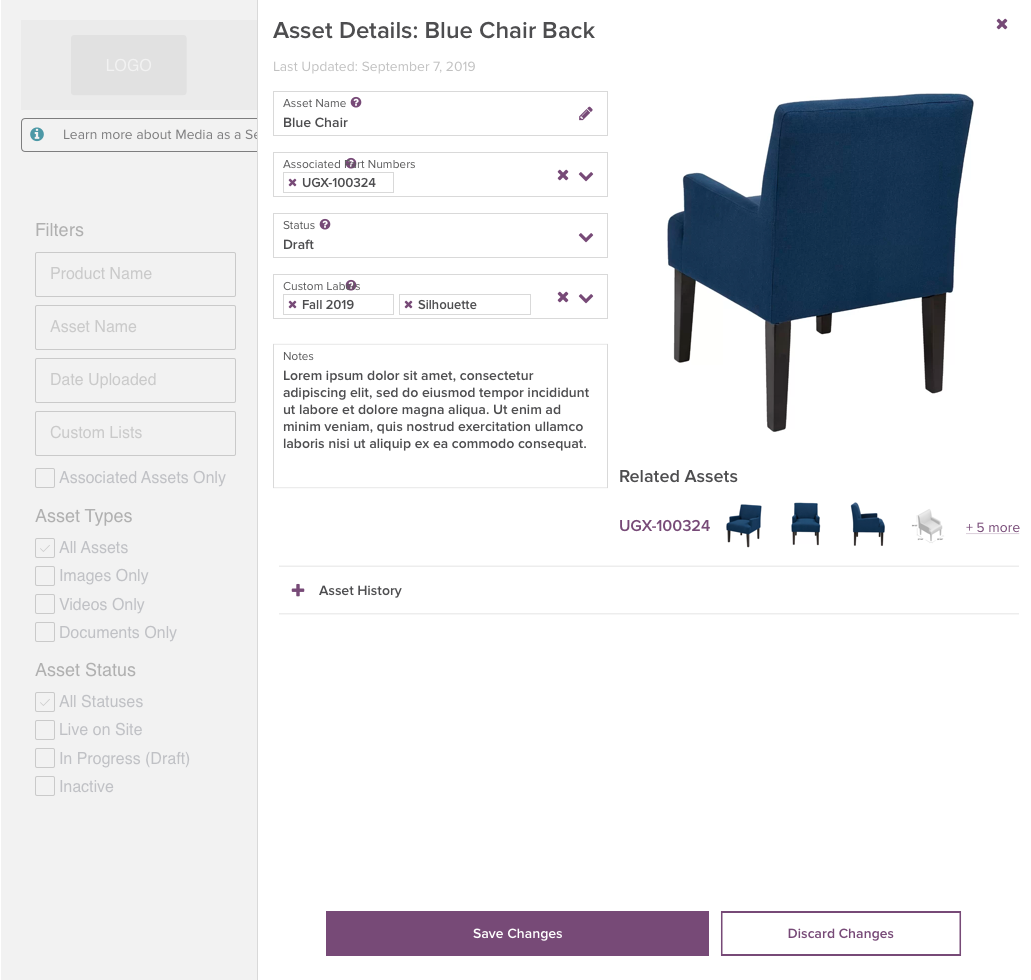

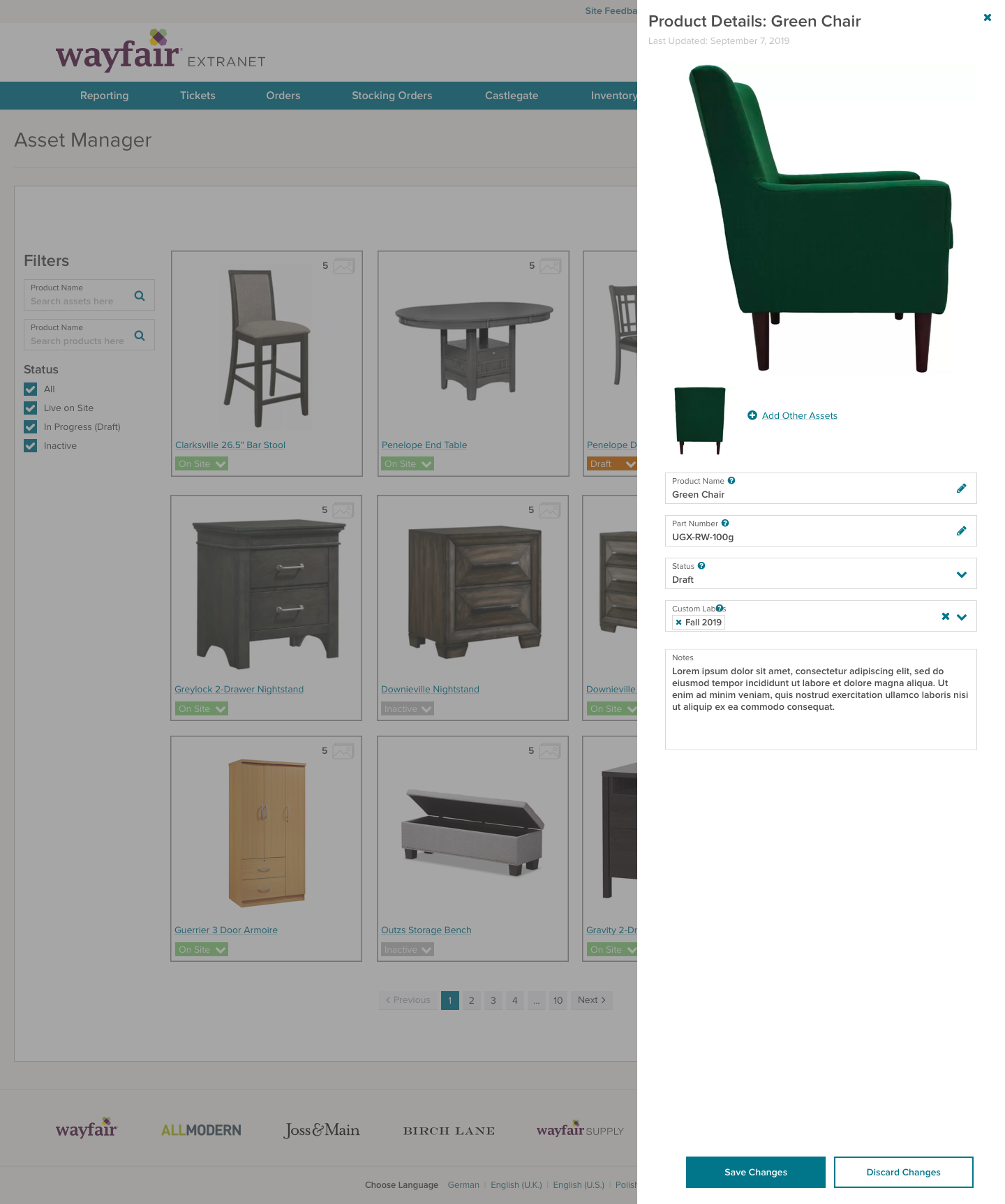

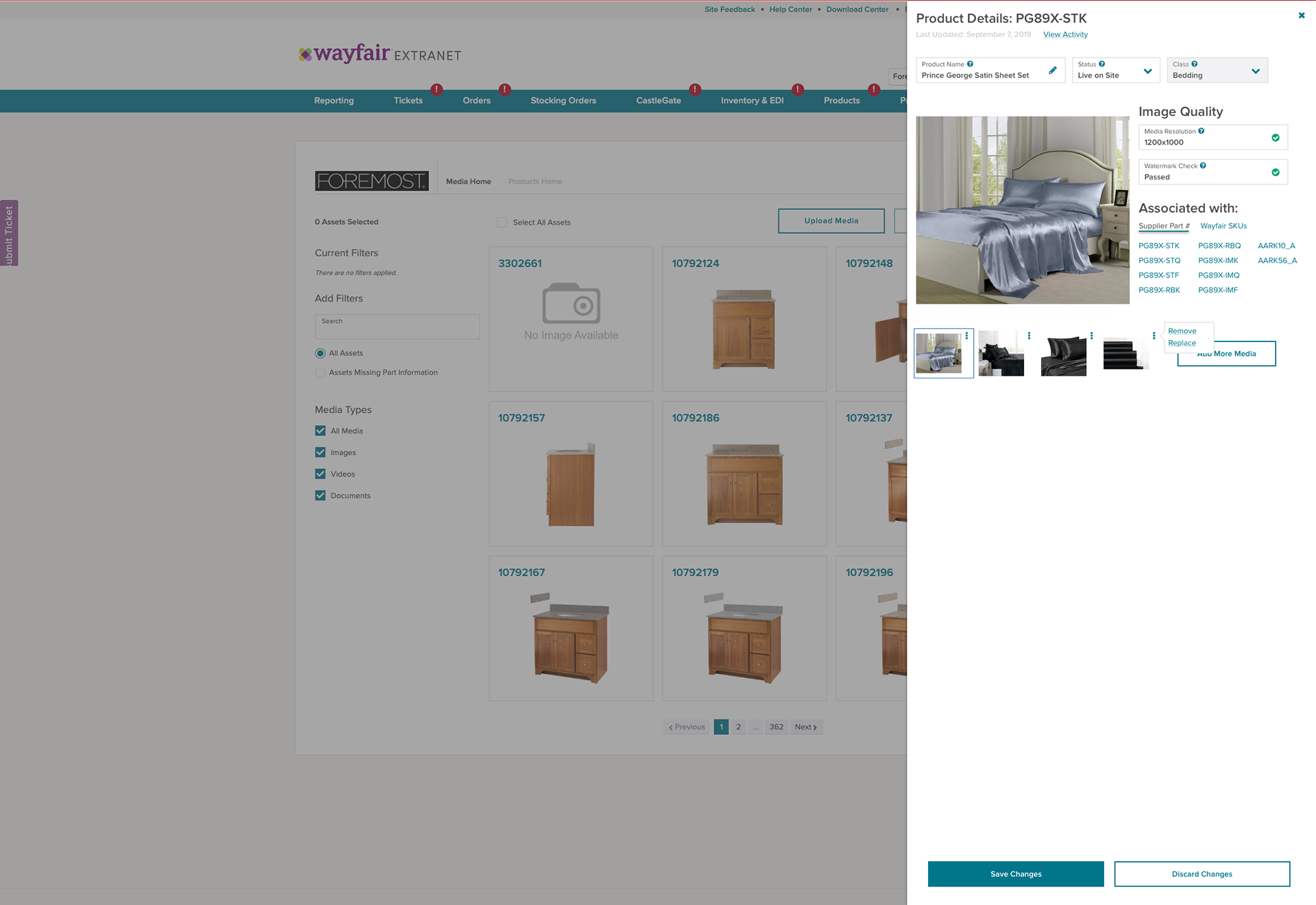

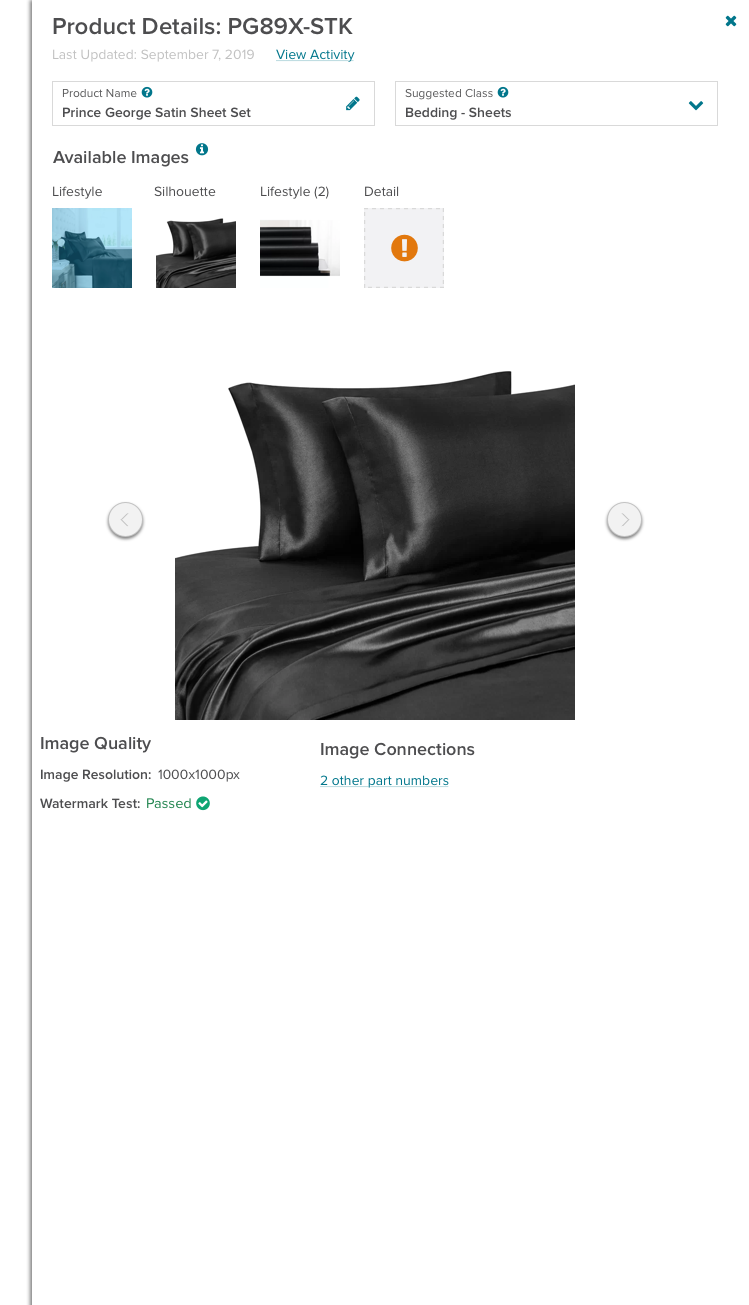

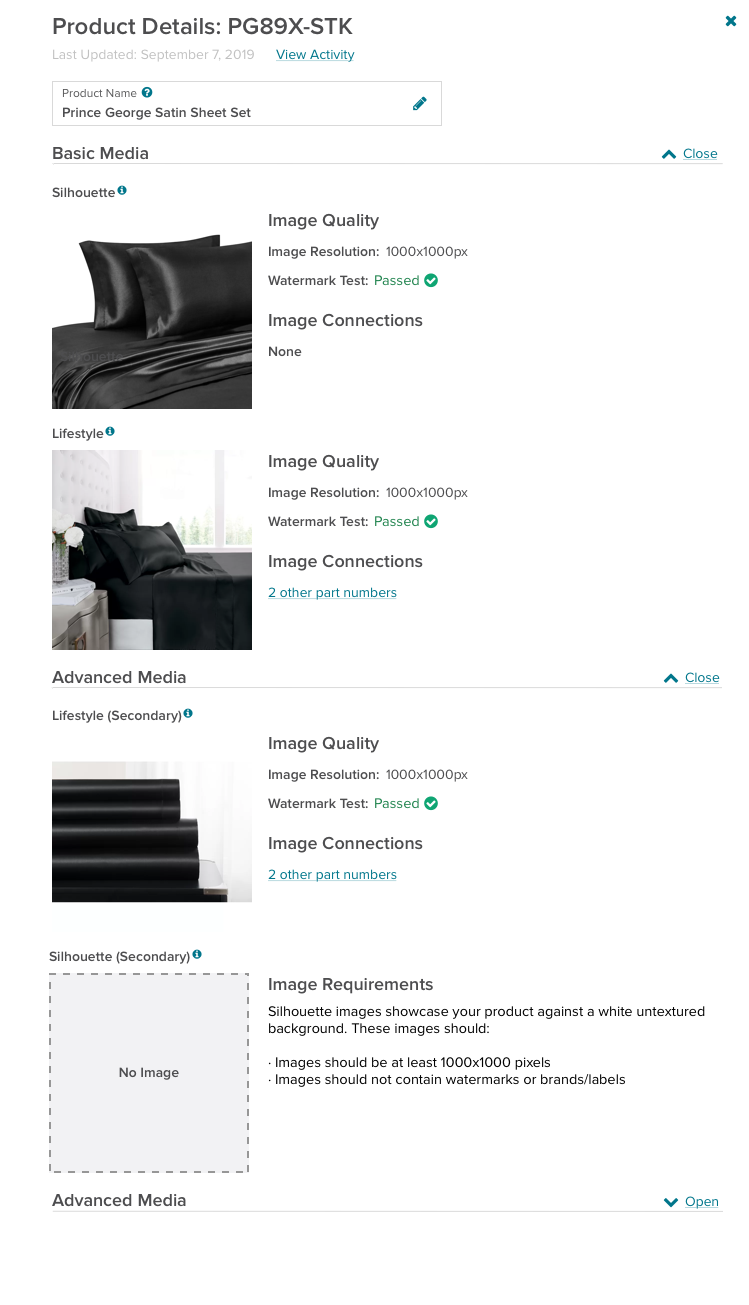

Version 1

Version 2

Version 3

Version 4

Version 5